excise tax ma calculator

The formula used to calculate this is the Manufacturers List Price x Ch60A. Enter your vehicle cost.

Car Tax By State Usa Manual Car Sales Tax Calculator

Excise tax bills are due annually for every vehicle owned and registered in Massachusetts.

. The formula used to calculate this is the Manufacturers List Price x Ch60A percentage Value for Excise. Massachusetts corporate excise tax is calculated by adding two different measures of tax depending on whether the corporation is a tangible or an intangible property. The amount of the motor vehicle excise due on any particular vehicle or trailer in any registration year is calculated by multiplying the value of the vehicle by the motor vehicle excise rate.

Massachusetts Property and Excise Taxes. If your vehicle is registered in. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged.

The excise due is calculated by multiplying the value of the vehicle by the motor. Note that while the statute provides for a 5 rate an uncodified surtax adds 7 to that rate. The excise rate is 25 per 1000 of your vehicles value.

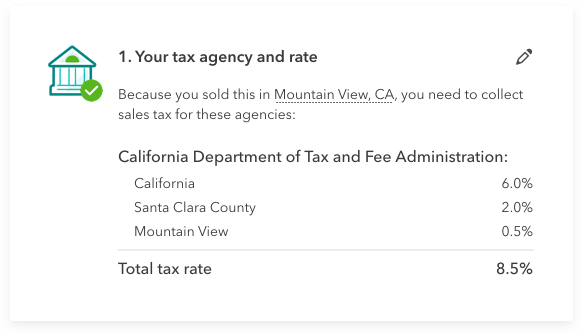

Total tax to be collected. If your vehicle is registered in. Excise tax bills are prepared by the Registry of.

Motor vehicle excise is taxed on the calendar year. The amount of the motor vehicle excise due on any particular vehicle or trailer in any registration year is calculated by multiplying the value of the vehicle by the motor vehicle excise rate. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged.

- NO COMMA For. Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. Consideration of Deed Total Excise Amount.

This guide has information about corporate excise tax from. Ad Avalara excise tax solutions take the headache out of rate determination and compliance. The rate of the excise tax is.

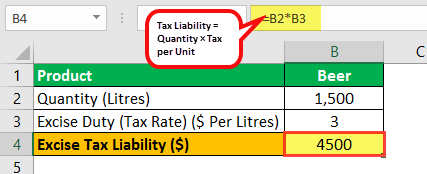

Calculation of Excise Tax. We are notifying you of a vehicle valuation issue that may affect the amount owed on vehicle owners 2022 excise tax. If you want to pay your excise tax in Massachusetts online you can use the online.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. The current excise tax rate for motor vehicles is 25 per 1000 of your vehicles value. For any consideration over 10000 please use the Excise Calculator below to determine the required excise tax.

Consideration between 100 and 10000 is not subject to excise tax. The excise rate is 25 per 1000 of your vehicles value. How often do you pay excise tax in MA.

The excise tax is 228 per 500. It is an assessment in lieu of a personal property tax. Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue.

Your household income location filing status and number of personal. Motor vehicle excise tax is assessed and levied each calendar year for every motor vehicle that is registered in the Commonwealth of Massachusetts. Value for Excise x Rate 25 or 0025 Excise Amount.

Generally all corporations operating in Massachusetts both foreign and domestic need to pay corporate excise tax. Corporate Excise Tax. Massachusetts imposes a corporate excise tax on certain businesses.

The states room occupancy excise tax rate is 57. Corporate excise can apply to both domestic and foreign corporations.

Sales Tax Software For Small Business Quickbooks

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

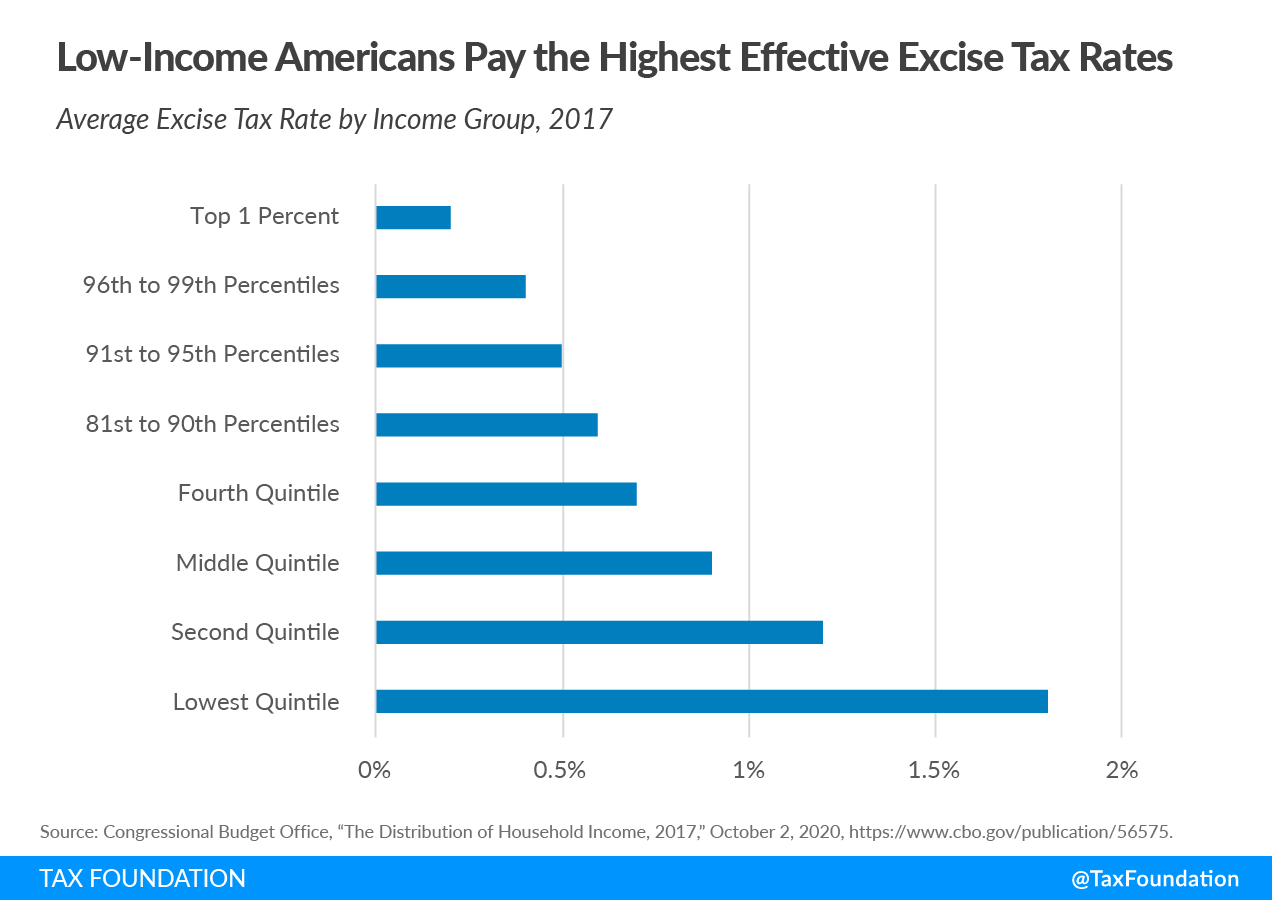

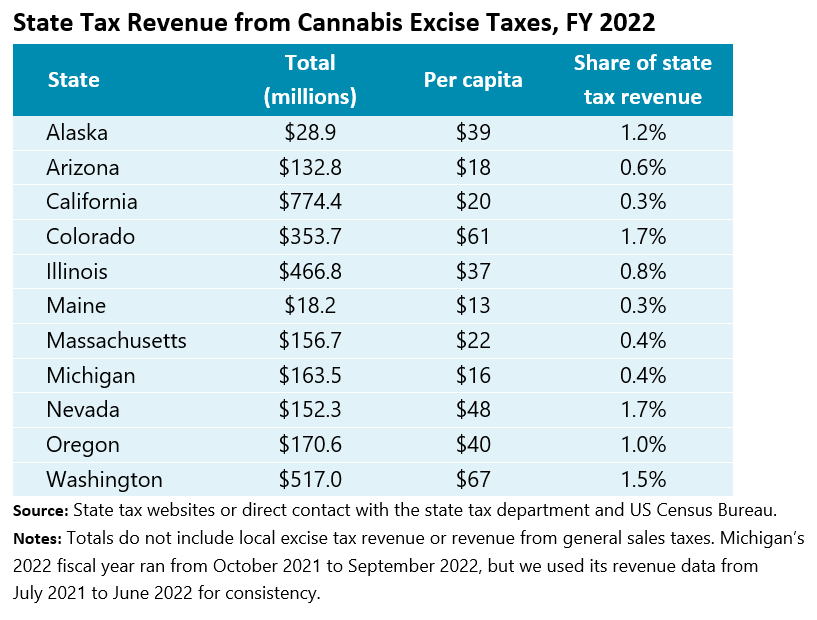

Excise Taxes Excise Tax Trends Tax Foundation

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

Uae Announces Changes To Excise Tax Law To Minimise Tax Avoi Menafn Com

Gas Tax Rates 2019 2019 State Fuel Excise Taxes Tax Foundation

Massachusetts Enacts Work Around To Federal 10 000 Salt Deduction Limitation Don T Tax Yourself

Vat Payment Online Uae Excise Tax Registration In Uae

Car Tax By State Usa Manual Car Sales Tax Calculator

Excise Tax Definition Types Calculation Examples

Ma Vehicle Excise Tax Johnson And Rohan Insurance

Cannabis Taxes Urban Institute

Massachusetts Gasoline And Fuel Taxes For 2022